-

CEI Africa Foundation Awards Africa GreenTec an RBF Grant to Densify 18 GMGs and Build 7 New GMGs in Rural Mali

- January 24, 2024

- Posted by: Emily Lundberg

- Category: News Items

No Comments

Stichting Clean Energy and Energy Inclusion for Africa (CEI Africa) signed a results-based financing (RBF) grant for a total of up to USD 1,953,000 to green mini-grid (GMG) developer Africa GreenTec for the densification of 18 mini grids and the construction of 7 mini grids in rural Mali.

-

CEI Africa Foundation Awards WeLight an RBF Grant to Densify 5 GMGs and Build 9 New GMGs in Rural Mali

- November 7, 2023

- Posted by: Emily Lundberg

- Category: News Items

Stichting Clean Energy and Energy Inclusion for Africa (CEI Africa) announces its intention to award a results-based financing (RBF) grant for a total of up to USD 1,886,700 to WeLight, a green mini-grid (GMG) developer, for the densification and construction of mini-grids in rural communities in Mali.

-

CEI Africa Foundation Awards RBF Grant to Nuru to Electrify Goma Region, DRC; To Be Largest Islanded Green Mini Grid in Sub-Saharan Africa

- September 12, 2023

- Posted by: Emily Lundberg

- Category: News Items

Stichting Clean Energy and Energy Inclusion for Africa (CEI Africa) announces its intention to award a results-based financing (RBF) grant for a total of up to USD 3,087,600 to Nuru, a green mini grid (GMG) developer in the Democratic Republic of Congo (DRC), for the creation of a 3.7MW solar mini grid with approximately 5,146 connections in underserved communities in the Goma region of DRC.

-

GreenMax’s Sylviah Mwaura Elected to GOGLA Board of Directors

- July 18, 2023

- Posted by: Emily Lundberg

- Category: News Items

Earlier this month, GreenMax gained representation on the Global Off-Grid Lighting Association (GOGLA) Board of Directors with the election of Sylviah Mwaura. Sylviah brings a wealth of experience and a diverse skill set to the role, promising to contribute to the continued growth and success of the organization.

-

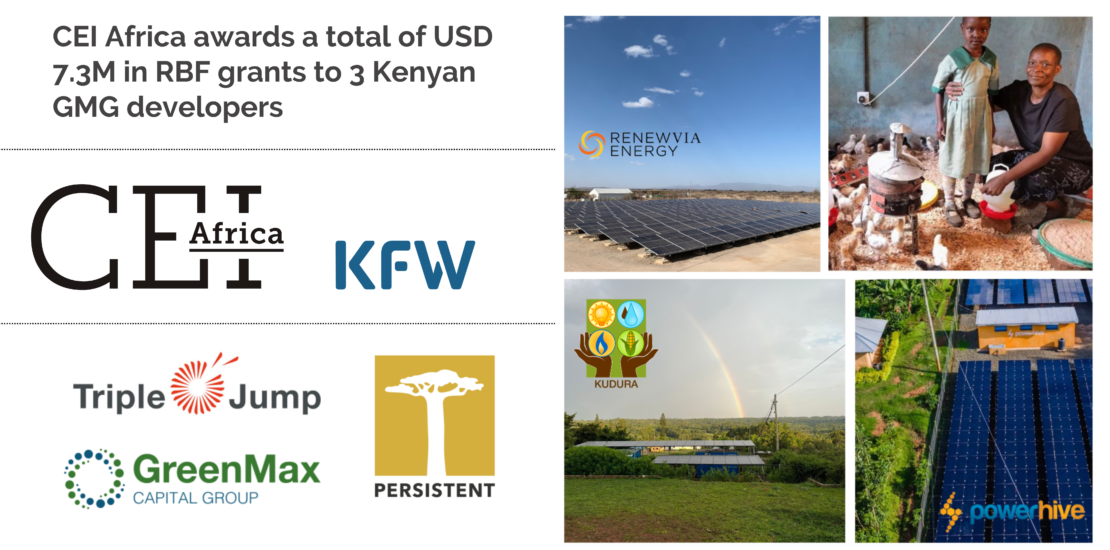

CEI Africa awards a total of USD 7.3M in RBF grants to 3 Kenyan GMG developers

- May 25, 2023

- Posted by: Emily Lundberg

- Category: News Items

Nairobi, Kenya, 26 May 2023–Stichting Clean Energy and Energy Inclusion for Africa (CEI Africa) announced today its intention to award three results-based financing (RBF) grants for a total of up to USD 7.3M to Kenyan green mini grid (GMG) developers Renewvia, Kudura and PowerHive for the creation of approximately 21,110 green mini grid connections in underserved communities in northern and south-western Kenya.

-

GreenMax Capital Group’s Africa Transaction Advisory Director Ifechukwude Uwajeh a panelist at NOMAP multi-stakeholder event on financing the productive use of energy to scale mini-grid development

- April 18, 2023

- Posted by: Emily Lundberg

- Category: News Items

In April 2023, Africa Transaction Advisory Director, Ifechukwude Uwajeh, was a panelist at the NOMAP Productive Use of Energy (PUE) stakeholder event on financing productive load assets to grow and scale mini-grid projects

-

GreenMax Capital Group Provides Transaction Advisory to VITALITE Zambia as the PayGO SHS Pioneer Secures USD 1.5M

- April 17, 2023

- Posted by: Emily Lundberg

- Category: News Items

GreenMax Capital Group is delighted to announce that our client, VITALITE Zambia, has achieved an important financing milestone, as the EU-funded Electrification Financing Initiative (EDFI ElectriFI) has committed to investing USD 1.5M in the company.

-

GreenMax Capital Group Wins ‘Best Finance Team of the Year’ at Kenya Solar Week Leadership Awards 2023

- April 15, 2023

- Posted by: Emily Lundberg

- Category: News Items

In early April 2023, GreenMax Capital Group’s Nairobi team was recognized as the “Best Finance Team of the Year” at the Kenya Solar Week Leadership Awards 2023.

-

Powerhive Mandates GreenMax for $33.5M Capital Raise to Support Expansion of Combined E-Mobility and C&I Solar Business in Kenya

- April 4, 2023

- Posted by: Emily Lundberg

- Category: News Items

In March 2023, U.S.-Kenyan energy developer Powerhive signed an agreement with GreenMax to serve as their exclusive transaction advisor for a $33.5M capital raise to support expansion of Powerhive’s combined E-mobility and C&I solar business in Kenya.

-

Global Off-Grid Solar Forum & Expo

- October 30, 2022

- Posted by: greenmax

- Category: News

In October 2022, GreenMax Capital Group formally launched three financing platforms—CEI Africa, Green-for-Access First Loss Facility (G4A), and GreenStreet Africa—at the Global Off-Grid Solar Forum and Expo in Kigali, Rwanda.

- 1

- 2