Our Mission

GreenMax promotes the growth of renewable energy, energy efficiency, energy access, financial inclusion and productive use of energy to support a sustainable and equitable energy transition across the developing world. We achieve these goals through the design and implementation of policy and regulation, the development and management of financing facilities, and the delivery of transaction advisory, capital raising and project development support services to private developers, investors and off-grid enterprises. Our mission is to leverage private capital, human resources and ingenuity to create positive climate impacts and foster sustainable economic development in some of the world’s poorest regions.

About Us

GreenMax Capital Group Ltd. is a specialized advisory and fund management firm focused exclusively on promoting clean energy solutions in emerging markets. We have successfully executed projects across five continents, with experience in more than 80 countries globally since 1994. GreenMax consists of seven registered companies across Ireland (holding company), the United States, Poland, Kenya and Chile, and has representation in offices throughout Africa, Europe and Latin America.

GreenMax supports project developers, renewable energy companies, investors, financial institutions, donor agencies and governments in the analysis, preparation and implementation of a broad range of clean energy investments, policies and regulations. We also work with regional commercial lenders to develop and implement lending products that target renewable energy and energy efficiency investments and support DFIs in their efforts to plan and launch market- transforming sustainable energy finance initiatives.

GreenMax has evolved beyond its roots in consultancy and is now considered one of the leading transaction advisory and fund management firms in the clean energy space for emerging markets. Drawing from our advisory work for developers and financiers, as well as our own direct development experience, we bring the perspective of hands-on practitioners to each assignment.

History of Innovation

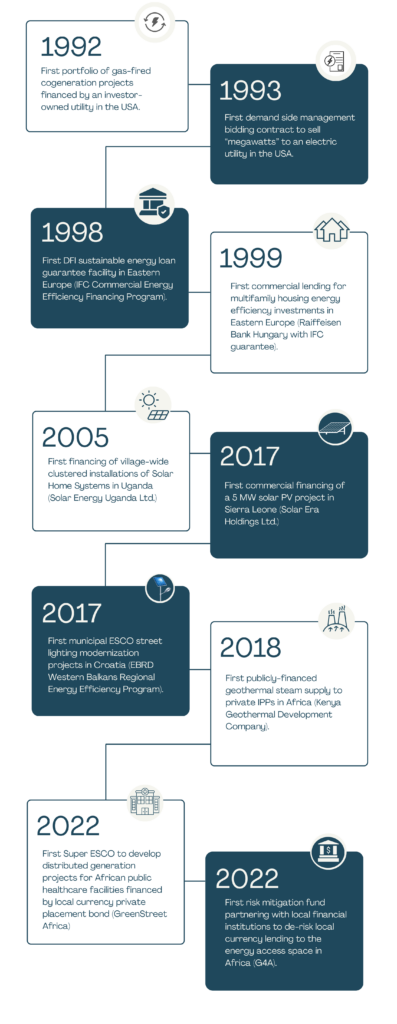

In the late 1980s and early 1990s, GreenMax principals played a key role in originating new approaches to facilitate energy efficiency and distributed generation investments in the USA. Our team designed one of the first ESCOs and implemented the first portfolio of on-site cogeneration projects in the state of New York, created the first Energy Performance Contracts for Public Housing Authorities and Diocesan properties and executed the first sale of “negawatts” under long-term verifiable contracts selling the saved kWh from motor and lighting retrofits at large institutional properties. Moreover, we brought electric and gas utilities, residential real estate companies and community trusts into the financing of these projects.

Beginning in the late 1990s in Eastern Europe, the GreenMax team designed and managed the launch of the first DFI-funded sustainable energy financing vehicles to partner with local FIs. Through the IFC sustainable energy guarantee programs, more than €400m in direct energy efficiency and small-scale renewable energy investments were financed by more than a dozen commercial lenders in five countries. We helped create an industry for financing energy efficiency improvements by commercial banks for multifamily blockhouse apartment buildings in the new democracies of 1990s Eastern Europe – a market segment with off-grid financing challenges that resemble those found in present-day Africa. Over the course of the last decade, we initiated receivables financing for ESCOs and brought the EBRD into partnership with local municipalities and small ESCOs in the Western Balkans to finance public sector energy efficiency improvements across the region.

Since 2005, we have applied innovative financing mechanisms to address both on-grid and off-grid energy investment challenges in countries throughout Africa, Asia, Latin America and the Caribbean. We have used our skills honed developing DFI and donor-funded instruments to facilitate commercial bank engagement in clean energy investments across these regions. More recently, through our fund management practice, we have become experts in the design and implementation of risk mitigation tools and technical assistance interventions to secure lender participation and deliver capital to the African off-grid sector.