GreenShift Africa

Trade Facilitation Program for Africa e-mobility Sector

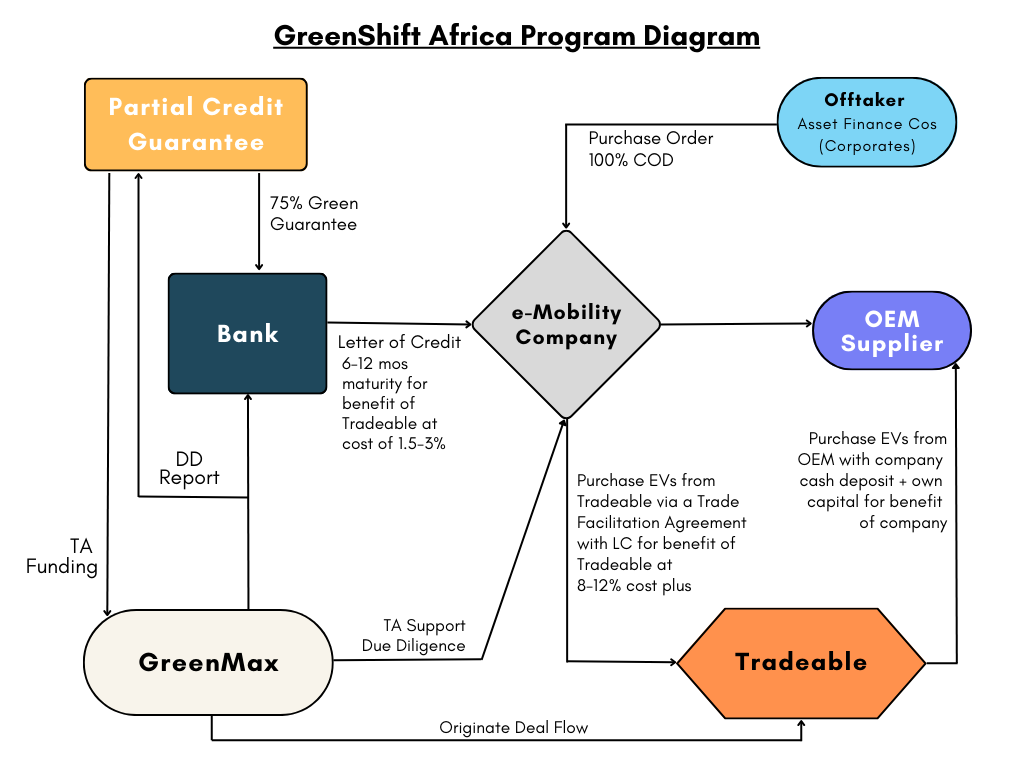

GreenMax’s engagement with e-Mobility companies in Africa has identified a common challenge among most of the companies for which a trade facilitation program can be offered as a solution. To implement this program, GreenMax has entered into a partnership with Tradeable House Africa, a Dubai/Nairobi- based trading company.

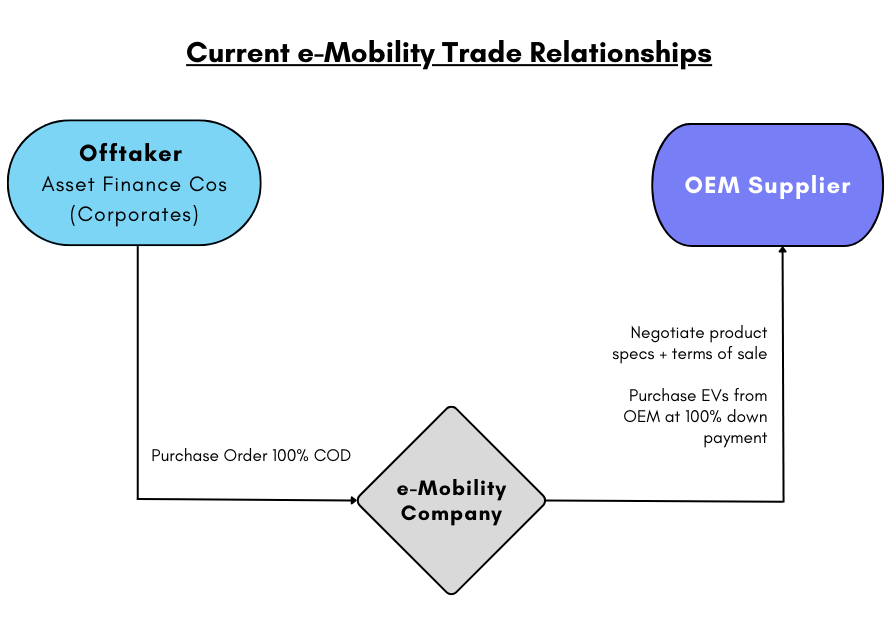

At present, the most frequent approach of e-Mobility companies to deliver 2 and 3 wheeler bicycles, motorbikes and scooters as well as buses to the market is through a sale to an offtaker. This can be an AssetFinCo, such as Watu, Mogo, M-KOPA, BBOXX etc. that then offers the EVs to individuals or corporate buyers under an extended payment plan, a direct corporate buyer or a bus company/SACCO. Unfortunately, at this early stage of market development, these offtakers have sufficient leverage to insist on paying only 100% COD. The e-Mobility company’s OEM suppliers, however, generally require 100% down payment prior to shipping. With limited equity raised (and most of that capital deployed to support ongoing product development and operations), e-Mobility companies have little cash available as working capital to purchase an inventory of EVs and batteries. This severely constrains growth potential at this critical time where all companies are vying for early market share.

For example, consider an e-Mobility company with $100K in available working capital. The company would need to use all of this to purchase around 100 motorbikes (without batteries), whereas the current demand calls for it to import at least 5 times that amount. Considering a typical importation scheme, this also ties up the limited working capital that the company has for at least 6 months if everything goes as planned or up to 9-12 months, considering a typical import delivery schedule:

- 1 month OEM assembly of order

- 2-3 months shipping

- 1-2 months customs clearance

- 1 month in country assembly

The current disadvantageous trade relationship is illustrated in the diagram below.

Through GreenMax’s partnership with Tradeable, a standard trading arrangement can be delivered to leverage on the e-Mobility company’s limited working capital and offtaker relationships to substantially increase the number of EVs they can import.

Tradeable is focused on promoting Trade into Africa, Trade out of Africa, Intra-Africa Trade and Structured Trade Finance. They source, aggregate and supply a wide-ranging assortment of quality finished goods, raw materials, energy products (solar, LPG, petroleum), building materials, equipment and food products, among others. Tradeable works alongside well-established suppliers, producers, manufacturers, retailers, construction companies and energy producers to make trade work better.

In addition to sourcing and supplying, Tradeable is actively involved in Trade Facilitation where the company supports buyers who already have their preferred suppliers and suppliers who already have their client base as described below.

Where Tradeable’s client is a buyer that has a preferred supplier but where the preferred supplier does not provide the client with sales terms that meet their expectations and/or business cycles, Tradeable signs a Trade Facilitation Agreement with the preferred supplier and client where Tradeable pays the supplier on sight/Cash Against Documents and then sells to the client at preferential sales terms that would include longer tenors such as 90 Days to 360 Days for commodities and light equipment. Additionally, Tradeable could sell to the client on Delivery At Place (DAP) or Delivery Duty Paid (DDP) Terms and thus include the cost of duty and logistics to the trade. The trade facilitation structure has several benefits, including:

- Allows clients to purchase products on longer credit terms (3 – 12 months);

- Allows clients to get the longer credit terms for duty and logistics costs; and

- Saves on Bank Interest Charges for the Letter of Credit tenor.

In the e-Mobility sector, Tradeable is offering to support the local E-Mobility resellers who already have strong offtakers in place for all or part of an import order. Tradeable will pay the e-Mobility companies’ OEMs up-front as required, while selling to the local resellers on differed payment terms that will be on a Delivered Duty Paid basis. Tradeable takes the e-Mobility company’s available cash as a down payment covering a portion (10-30% based on assessment of risk) of the order value and then deploys its own capital to multiply the purchasing power of the transaction. Tradeable earns a margin on transaction which may range from 8-15% depending on the size and metrics of the deal. While Tradeable prefers deal sizes of at least $1M in value, to help kick-start the e-Mobility business, they are prepared to do transactions as low as $200-300K, particularly to support African-owned companies to compete and become first movers. Tradeable’s engagement in each transaction is underwritten by a Letter of Credit issued by a local bank which backs the payment from the e-Mobility company to Tradeable on the agreed upon terms.

As the e-Mobility space is a high-priority area for banks to fulfill their green finance goals, there is a strong willingness to engage. While of course each presented transaction will be reviewed on its own merits, banks indicate that they will require third party guarantees. GSA will work with Third Party Partial Credit Guarantee Providers in order to unlock the Letter of Credits required by Tradeable. Banks that Tradeable typically works with in East Africa include: ABSA, Cooperative Bank, Credit Bank, Equity Bank, Ecobank, I&M Bank, Family Bank, Middle East Bank and NCBA. The diagram below illustrates how the Africa Green Shift Trade Finance Facility works.

For more information, contact:

David Ekabouma: dekabouma@greenmaxcap.com

Sylviah Mwaura: smwaura@greenmaxcap.com