Our Mission

GreenMax Capital Group is a premier fund management and advisory firm advancing sustainable development in emerging markets. We believe that universal energy access is the linchpin of economic development that enables, connects and accelerates progress across sectors. Our mission is to promote investment in solutions that drive a just energy transition, strengthen climate-positive infrastructure, and deploy catalytic technologies for sustainable energy, transport, agriculture and industry — and in turn support financial inclusion, improve livelihoods, and unlock opportunities for the world’s most vulnerable populations.

About Us

GreenMax Capital Group Ltd. is a specialized fund management and advisory firm advancing sustainable investment across emerging markets. Since 1994, we have implemented projects on five continents and in more than 80 countries worldwide. GreenMax comprises seven registered companies across Ireland (holding company), the United States, Poland, Kenya, and Chile, with representation throughout Africa, Europe, and Latin America.

Building on three decades of experience, GreenMax designs and manages blended-finance platforms that mobilize private capital toward sustainable energy, mobility, agriculture, and climate-resilient infrastructure. We work with project developers, investors, financial institutions, DFIs, and governments to structure and implement financing solutions that drive inclusive growth and climate-positive outcomes.

Having evolved beyond our consultancy roots, GreenMax today is recognized as a leading fund management and advisory partner in emerging markets. Drawing on our advisory heritage and direct fund management track record, we bring the perspective of hands-on practitioners to every assignment — from concept design and capital structuring to on-the-ground implementation.

History of Innovation

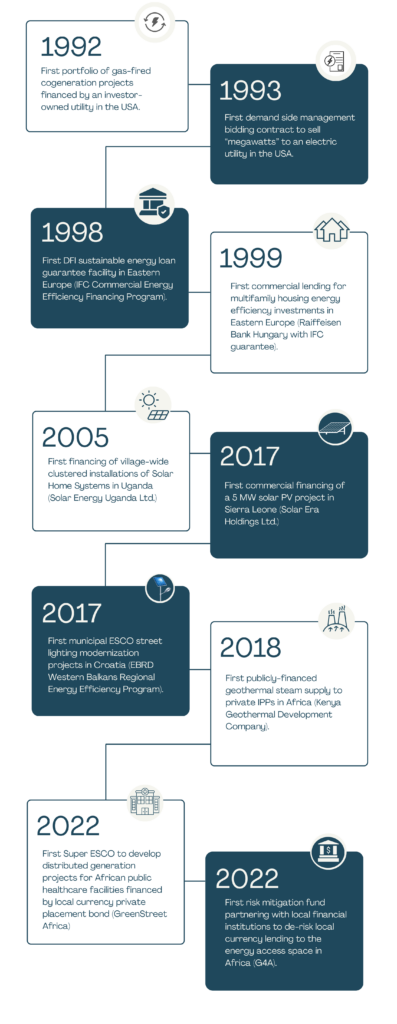

In the late 1980s and early 1990s, GreenMax principals played a key role in originating new approaches to facilitate energy efficiency and distributed generation investments in the USA. Our team designed one of the first ESCOs and implemented the first portfolio of on-site cogeneration projects in the state of New York, created the first Energy Performance Contracts for Public Housing Authorities and Diocesan properties and executed the first sale of “negawatts” under long-term verifiable contracts selling the saved kWh from motor and lighting retrofits at large institutional properties. Moreover, we brought electric and gas utilities, residential real estate companies and community trusts into the financing of these projects.

Beginning in the late 1990s in Eastern Europe, the GreenMax team designed and managed the launch of the first DFI-funded sustainable energy financing vehicles to partner with local FIs. Through the IFC sustainable energy guarantee programs, more than €400m in direct energy efficiency and small-scale renewable energy investments were financed by more than a dozen commercial lenders in five countries. We helped create an industry for financing energy efficiency improvements by commercial banks for multifamily blockhouse apartment buildings in the new democracies of 1990s Eastern Europe – a market segment with off-grid financing challenges that resemble those found in present-day Africa. Over the course of the last decade, we initiated receivables financing for ESCOs and brought the EBRD into partnership with local municipalities and small ESCOs in the Western Balkans to finance public sector energy efficiency improvements across the region.

Since 2005, we have applied innovative financing mechanisms to address both on-grid and off-grid energy investment challenges in countries throughout Africa, Asia, Latin America and the Caribbean. We have used our skills honed developing DFI and donor-funded instruments to facilitate commercial bank engagement in clean energy investments across these regions. More recently, through our fund management practice, we have become experts in the design and implementation of risk mitigation tools and technical assistance interventions to secure lender participation and deliver capital to the African off-grid sector.